The Priceline Rewards Visa Card is a credit card that offers a variety of benefits, including rewards, travel discounts, and more.

To start using your Priceline Rewards Visa Card, you will need to activate it via PriceLineRewardsVisa/Activate Login.

PriceLineRewardsVisa/Activate Login

In this guide, we will cover everything you need to know about activating your Priceline Rewards Visa Card via PriceLineRewardsVisa/Activate Login, including how to do it and what benefits it offers.

How to Activate Your Priceline Rewards Visa Card?

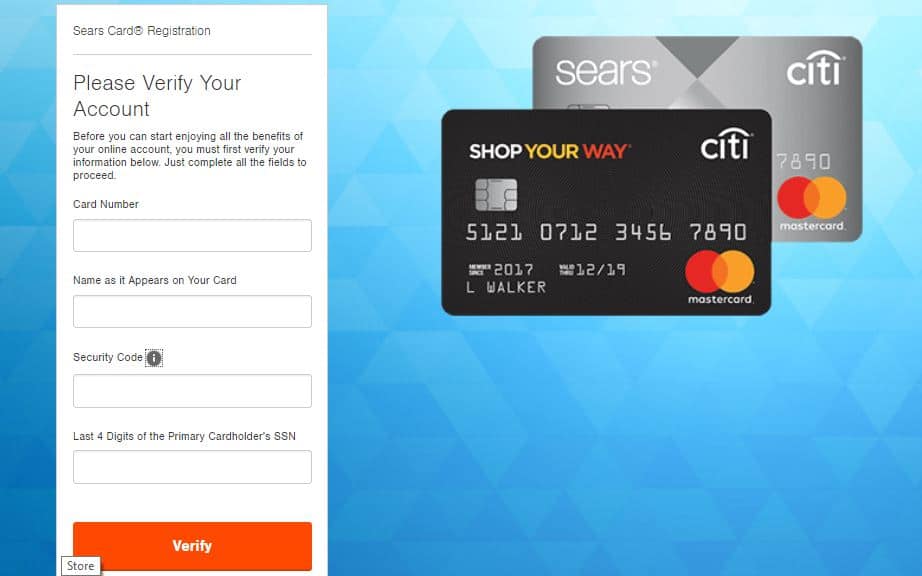

To activate your Priceline Rewards Visa Card, follow these steps:

- Visit the Priceline Rewards Visa Card activation page.

- Enter your card information, including the card number and security code.

- Follow the prompts to complete the activation process.

Once your Priceline Rewards Visa Card is activated, you can start using it to make purchases and earn rewards.

Benefits of the Priceline Rewards Visa Card

The Priceline Rewards Visa Card offers several benefits, including:

- Rewards: The Priceline Rewards Visa Card allows you to earn rewards on all of your purchases, which can be redeemed for travel, merchandise, and more.

- Travel Discounts: The Priceline Rewards Visa Card offers a variety of travel discounts, including discounts on flights, hotels, and rental cars.

- No Annual Fee: The Priceline Rewards Visa Card has no annual fee, making it a cost-effective option for managing your finances.

- Security: The Priceline Rewards Visa Card uses the latest security measures to protect your personal and financial information, giving you peace of mind when making purchases.

- Easy to Use: The Priceline Rewards Visa Card is easy to use, with a simple and intuitive interface that makes it easy to manage your finances.

How to Manage Your Priceline Rewards Visa Card Online?

Managing your Priceline Rewards Visa Card online is easy and convenient. By logging in to your account on the Priceline Rewards Visa Card website, you can:

- View your transactions: View a record of all your transactions, including the date, amount, and location of each purchase.

- Make payments: Make payments on your Priceline Rewards Visa Card easily and securely online.

- View your rewards: View your rewards balance and see how many points you have earned.

- Update your information: Update your personal information, such as your address and phone number, as needed.

- Report a lost or stolen card: If your Priceline Rewards Visa Card is lost or stolen, you can report it online and request a replacement card.

How to Redeem Your Rewards?

Redeeming your rewards is easy with the Priceline Rewards Visa Card. To redeem your rewards, follow these steps:

- Log in to your account on the Priceline Rewards Visa Card website.

- View your rewards balance to see how many points you have earned.

- Select the reward you want to redeem your points for, such as travel, merchandise, or statement credits.

- Follow the prompts to complete the redemption process.

- Enjoy your reward!

Types of Rewards Available

The Priceline Rewards Visa Card offers a variety of rewards to choose from, including:

- Travel: Redeem your rewards for travel, including flights, hotels, rental cars, and more.

- Merchandise: Choose from a variety of merchandise, including electronics, home goods, and more.

- Statement Credits: Use your rewards to reduce the balance on your Priceline Rewards Visa Card.

- Gift Cards: Choose from a variety of gift cards, including restaurant gift cards, retail gift cards, and more.

- Cash Back: Redeem your rewards for cash back, which can be applied to your Priceline Rewards Visa Card account.

How to Maximize Your Rewards?

To maximize your rewards with the Priceline Rewards Visa Card, consider the following tips:

- Use your card for all purchases: Use your Priceline Rewards Visa Card for all of your purchases to earn rewards on everything you buy.

- Choose rewards that align with your spending habits: Choose rewards that align with your spending habits, such as travel rewards if you travel frequently or merchandise rewards if you love shopping.

- Pay your balance in full each month: Pay your balance in full each month to avoid interest charges and maximize your rewards.

- Take advantage of special promotions: Take advantage of special promotions, such as bonus rewards for certain types of purchases, to maximize your rewards.

- Plan ahead: Plan ahead and redeem your rewards in advance of a big purchase, such as a vacation or holiday shopping.

Additional Features of the Priceline Rewards Visa Card

In addition to its rewards program, the Priceline Rewards Visa Card offers several other features that make it a great option for managing your finances. These features include:

- Travel Accident Insurance: The Priceline Rewards Visa Card offers travel accident insurance, providing coverage for you and your family when you travel.

- Auto Rental Collision Damage Waiver: The Priceline Rewards Visa Card offers an auto rental collision damage waiver, providing coverage for damage to a rental car.

- Roadside Assistance: The Priceline Rewards Visa Card offers roadside assistance, providing help when you need it on the road.

- Fraud Protection: The Priceline Rewards Visa Card offers fraud protection, helping to protect you from unauthorized purchases.

- 24/7 Customer Service: The Priceline Rewards Visa Card offers 24/7 customer service, providing support when you need it.

How to Monitor Your Account?

Monitoring your Priceline Rewards Visa Card account is important to ensure that your account is in good standing and that you are taking advantage of all the benefits the card has to offer. To monitor your account, consider the following tips:

- Check your account regularly: Check your account regularly to stay on top of your spending and rewards.

- Review your transactions: Review your transactions to ensure that all purchases are accurate and that you have been credited with the correct amount of rewards.

- Monitor your rewards balance: Monitor your rewards balance to ensure that you are earning rewards on all of your purchases and to plan for future redemptions.

- Keep track of your credit score: Keep track of your credit score to ensure that your account is in good standing and that you are using your credit responsibly.

- Check for updates and promotions: Check for updates and promotions from the Priceline Rewards Visa Card, such as new rewards, special offers, and more.

Managing Your Card

Managing your Priceline Rewards Visa Card is easy with the tools and resources available through the card issuer. To manage your card, consider the following tips:

- Use online account management: Use online account management to view your account information, make payments, view your rewards, and more.

- Stay within your credit limit: Stay within your credit limit to avoid over-limit fees and maintain a good credit score.

- Make payments on time: Make payments on time to avoid late fees and maintain a good credit score.

- Monitor your credit utilization: Monitor your credit utilization to ensure that you are using your credit responsibly and to maintain a good credit score.

- Report lost or stolen cards: Report lost or stolen cards immediately to prevent unauthorized purchases and to ensure that your account remains in good standing.

Additional Benefits of the Priceline Rewards Visa Card

In addition to its rewards program and other features, the Priceline Rewards Visa Card offers several other benefits, including:

- Flexible payment options: The Priceline Rewards Visa Card offers flexible payment options, including the ability to make payments online, by phone, or by mail.

- Zero liability for fraudulent purchases: The Priceline Rewards Visa Card offers zero liability for fraudulent purchases, helping to protect you from unauthorized purchases.

- Travel benefits: The Priceline Rewards Visa Card offers a variety of travel benefits, including travel accident insurance, auto rental collision damage waiver, and roadside assistance.

- Credit education resources: The Priceline Rewards Visa Card offers credit education resources, including tips on how to use credit responsibly and how to maintain a good credit score.

- Easy application process: The Priceline Rewards Visa Card offers an easy application process, allowing you to apply online and receive a decision quickly.

Conclusion

The Priceline Rewards Visa Card is a credit card that offers a variety of benefits, including rewards, travel discounts, and more.

To start using your Priceline Rewards Visa Card via PriceLineRewardsVisa/Activate Login, you will need to activate it, which is easy to do by following the steps outlined in this guide.

With its rewards program, travel discounts, no annual fee, security measures, and easy-to-use online account management, the Priceline Rewards Visa Card is a great choice for anyone looking to manage their finances with ease.

So if you’re in the market for a credit card, be sure to consider the Priceline Rewards.