MeetBrightway/Apply Now for OMF Brightway Card – With so many credit cards on the market these days, it can be overwhelming trying to choose the right one for your needs. One great option to consider is the OneMain Financial (OMF) Brightway Card.

This card offers some nice perks that make it worth a close look. In this guide, we’ll provide key information on the Brightway Card and walk through how to apply so you can decide if it’s a good fit for you.

MeetBrightway/Apply Now for OMF Brightway Card

What is the OMF Brightway Card?

The Brightway Card is a credit card offered by OneMain Financial, a personal loan company. The Brightway Card comes in two versions – the standard Brightway Card and the Brightway+ Card.

Both offer cashback rewards, easy mobile access, and the ability to potentially improve your credit by making on-time payments.

Here are some quick facts about the Brightway credit cards:

- Credit limits of $500 for Brightway and $3,000 for Brightway+.

- No annual fee for Brightway+, $65 annual fee for regular Brightway.

- Both cards offer 1% unlimited cash back rewards on purchases.

- Fraud protection and zero liability policies against unauthorized charges.

- Opportunity to earn credit limit increases and APR decreases by meeting “milestones.”

- Mobile app for easy account access and management.

The Brightway+ Card is essentially an upgraded version of the standard Brightway Card. The higher credit limit, lack of an annual fee, and increased milestone reward opportunities make Brightway+ the better choice for those who qualify.

Key Benefits of the Brightway Credit Cards:

There are several advantages that make the OMF Brightway cards a smart option to consider:

- Cashback rewards: You earn unlimited 1% cash back on all purchases. This cashback can be redeemed for statement credits to offset purchases. This is free money back for spending you were already doing.

- Potential to improve credit: By making on-time payments, you can potentially improve your credit score over time. This helps qualify for better credit products down the road.

- Milestone incentives: Milestones allow you to earn a credit limit increase or APR decrease by meeting certain requirements in under 6 months. This helps improve your access to credit and reduce interest costs.

- Mobile account access: Manage your account and view statements easily via the OneMain app. This makes monitoring your account convenient.

- No late fees: OneMain does not charge late fees, allowing some flexibility if you happen to miss a payment occasionally. Interest will still accrue, however.

Considering these benefits, the Brightway Card presents a solid option especially if you have average credit. Responsible use can help build your credit profile for the future.

How Does the Application Process Work?

Applying for the OMF Brightway Card is relatively quick and simple. Here is an overview of what to expect:

- Check eligibility. The Brightway Card is only available to current OneMain customers or those who receive a mailed offer. Check to see if you meet the eligibility requirements.

- Submit application. Complete the online or mailed application providing basic personal and financial information. This is used to pull your credit reports.

- Get approved. If approved, you will receive an offer code and welcome materials by mail within 7-10 days. This contains your new credit card.

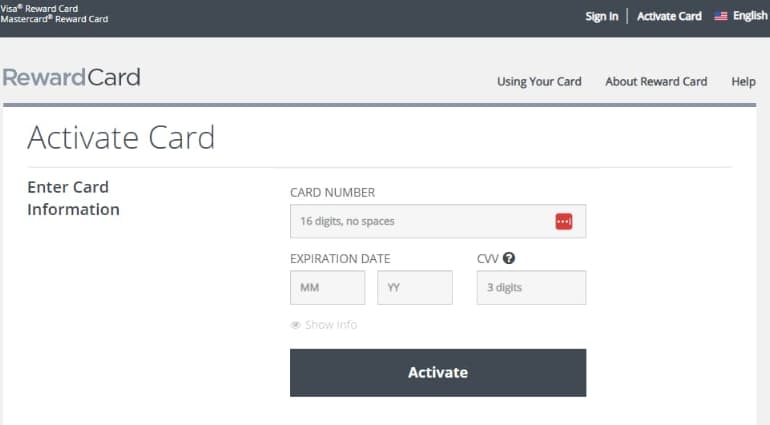

- Activate card. Once you receive your card, call the number on the sticker to activate it and set up your PIN. Your card is now ready to use once activated.

- Set up an online account. Register your account on the OneMain website or mobile app. This is where you can check balances, make payments, view statements, and more.

The entire process from application to getting an activated card can be completed in around two weeks in most cases. Be sure to provide accurate information on your application for the best approval chances.

What Credit Score is Needed?

OneMain considers applicants across a wide range of credit scores. They focus more on your overall credit profile versus just your score. Here are some general credit score guidelines, however:

- Very poor credit (below 580): Probably will not qualify but can still try applying in case of factors beyond your score that help your approval odds.

- Fair credit (580-669): Decent approval chances since OneMain specializes in loans/cards for average credit borrowers.

- Good credit (670-739): Very high chance of approval with good rates.

- Excellent credit (740+): Easy approval but this card is more geared for those rebuilding or establishing credit.

Your credit score is not the only factor. OneMain also considers income, existing debts, and other aspects of your credit report. Do not let an average score deter you from applying. Many get approved in the fair credit range.

Factors to Consider Before Applying

While the Brightway Card presents some nice perks, make sure it aligns with your needs by considering these key factors:

- Fees – The standard Brightway Card has a $65 annual fee after the first year. The Brightway+ Card has no annual fee. Avoid fees you do not want.

- APR – The purchase and cash advance APR is around 27%. This is fairly standard but make sure you can pay in full each month.

- Credit limit – The $500 limit on the Brightway Card may be too low depending on your spending. The $3,000 limit on the Brightway+ gives more flexibility.

- Existing credit – If new to credit, this card can help you build history. Those with established credit may find better reward cards.

- Paying the balance – With a variable APR of around 27%, interest can accrue quickly if you carry a balance. Pay in full each month if possible.

For those new to credit or with average/fair credit, the Brightway Card can be a great starter card to build credit responsibly. Just be mindful of the above factors when weighing if it fits your scenario.

Comparing the Brightway and Brightway+ Cards

Since OneMain offers both a standard Brightway Card and an upgraded Brightway+ Card, it is worth comparing the key differences between the two:

- Credit limit: Brightway has a $500 limit. Brightway+ offers a higher $3,000 initial limit.

- Annual fee: Brightway+ has no annual fee while Brightway has a $65 annual fee after the first year.

- Milestones: Both offer milestones but Brightway+ has increased opportunities to earn rewards.

- Cash back: Both offer an unlimited 1% cash back on all purchases.

- Upgrade option: Those with a Brightway Card can upgrade to a Brightway+ version later by meeting milestones.

Overall, the Brightway+ Card provides better features and value with its higher limit, lack of annual fee, and increased milestone reward chances.

But for those starting out, the Brightway Card can be a good entry-level card and later upgraded to the Brightway+ version.

What Kinds of Purchases Can You Make?

The Brightway Card works just like any other Mastercard credit card when making purchases. It can be used virtually anywhere that accepts Mastercard. Here are some common types of purchases you can make:

- Groceries and dining – Use the card at the supermarket, restaurants, and cafes. Earn 1% back.

- Gas and transit – Pay at the pump or load public transit cards. Receive cash back rewards.

- Shopping – Clothing stores, electronics stores, department stores. Get 1% back on your purchases.

- Medical – Pay doctors, dentists, vision care. Or use for prescriptions.

- Travel – Book flights, hotels, and rental cars. Then use the card when traveling.

- Online shopping – Shop at online retailers that accept Mastercard. Amazon, eBay, and more.

- Subscriptions – Set up recurring payments like Netflix, gym memberships, and newspaper subscriptions.

- Bills – Use it to pay your utilities, cell phone bills, and insurance bills.

You can use the Brightway Card anywhere Mastercard is accepted – in person, online, or over the phone. It works just like any credit card making it easy and convenient.

Tips for Responsible Use

When using your new OMF Brightway Card, be sure to practice responsible habits. This will help you avoid interest charges and build your credit wisely:

- Pay in full each month – Avoid interest by paying off your statement balance in full and on time.

- Set payment reminders – Set up alerts or calendar reminders so you never miss a payment due date.

- Limit large purchases – Big purchases can be hard to pay off quickly. Try to avoid buying more than you can realistically pay back monthly.

- Read statements – Review transactions and statements regularly to catch any unauthorized activity.

- Spend within your means – Be realistic about your budget and only charge what you can afford.

- Consider needs vs wants – Stick to more needs-based purchases and avoid overspending on wants.

- Build credit slowly – Use the card lightly at first and gradually increase activity as your credit situates.

- Create an online account – Take advantage of the mobile app and online account to monitor your spending.

Following these tips will help you maximize the benefits of the card while using it prudently.

The Brightway Card from OneMain Financial offers a straightforward way to earn cash back while potentially building your credit.

Just be sure to weigh the key factors like fees, credit limit, interest rate, and your repayment ability. Apply online once you’ve compared the details to other cards.

With responsible use, a Brightway Card can be a strategic first step on your credit journey.

Getting Started With Your New Brightway Card

Once you’ve been approved and received your Brightway Card in the mail, you’ll need to activate it and set up your online account. Here are some tips for getting started and making the most of your new card right away:

Activating Your Card

- Call the number on the sticker on your card. This is usually on the front or back.

- You’ll need to provide identifying information like SSN, birthdate, etc.

- Set up your unique PIN number for card security when making transactions.

- Your card is now active! You can begin using it for purchases.

Register Your Online Account

- Visit OneMain.com and look for the option to register your account.

- Enter your card number, and account verification info, and create a username/password.

- Provide your email, phone number, and other contact information.

- Choose your preferences for online statements, alerts, payment reminders, and more.

- Start managing your account online 24/7!

Making Your First Purchase

- Now that your card is active, go ahead and make your first purchase. This helps get the rewards rolling.

- Try starting small – fill up your gas tank, and pick up a few grocery items.

- Be sure the merchant accepts Mastercard before using your Brightway Card.

- Sign your name on the receipt as you would any other credit card.

- Check your account online to see the pending transaction.

Optional: Set Up Account Autopay

- Log into your OneMain account and find the autopay settings.

- Link your bank account. Enter your routing and account number.

- Choose a payment date and amount to pay each month.

- Autopay helps avoid missed payments and interest charges.

Start Earning Rewards

Now it’s time to start maximizing your 1% unlimited cash back on every purchase. Be sure to use the card for all your daily spending now that it’s activated and ready to go. Swiping your new Brightway Card makes earning rewards a breeze.

Additional Tips and Reminders

Here are some final pointers to keep in mind as you start using your Brightway Card:

- Download the OneMain app on your smartphone for easy account access on the go.

- Opt-in to transaction alerts to monitor spending and catch unauthorized charges.

- Make payments by the due date to avoid interest fees.

- Contact customer service with any questions as you get started.

- Check your credit report periodically to monitor your credit-building progress.

- Take advantage of milestone opportunities to earn credit line increases and APR reductions.

With your new card now activated, registered online, and ready for purchases, you can start benefiting from the many perks of the Brightway Card. Enjoy earning cashback and building your credit!

Also Check:

- Plaza Tire Credit Card Login

- BMO Harris Express Loan Pay Login

- JetBlueMastercard com Login

- www.MercuryCards.com/Activate

Conclusion:

Getting a new credit card can seem complicated, but the OMF Brightway Card makes the process straightforward. This card offers cash back rewards, and milestones to improve your credit and mobile access – all with no late fees. The Brightway+ version provides an even better value.

When weighing your options, be sure to consider factors like fees, credit limits, interest rates, and your repayment ability. With responsible use, the OMF Brightway Card presents a nice starter card for those looking to build their credit history.

Ready to apply? You can submit your application online by visiting MeetBrightway/Apply Now for the OMF Brightway Card. The application process is quick and approval decisions are made rapidly.

Once approved, you’ll receive your new OMF Brightway Card in the mail in about 1-2 weeks. Activate it, set up your online account, and start earning unlimited 1% cash back on purchases. Make on-time payments to build your credit score over time.

With the right education on how to maximize its benefits, the OMF Brightway Card can be a strategic first credit card to establish and strengthen your credit profile for the future. Visit MeetBrightway.com/ApplyNow today to explore your options and submit an application to get started on your credit journey.