MyAvantCard.com – All the customers will get a mail proposal in their mail as an invitation from the company to apply for myavantcard online. As well, it is only for the pre-selected customer who might be able to visit the official website online to check out or to get to know about your qualification for this credit card or not.

The Avant Credit Card is not the best in town when it comes to cards for so-so credit. But it’s got some things in its favor you might not find with other options. If you’re new to credit or had a few missteps, it can be difficult to find a card that doesn’t need an upfront security deposit.

MyAvantCard.com

But the Avant card is unsecured so you won’t have to horse up anything to get it. If you want to know more about MyAvantCard then read this article carefully.

MyAvantCard Mastercard

Avant is one of the companies which is previously known as AvantCredit it is a private company located in Chicago and it is one of the financial technology companies. It was presented in the year 2012 and this company introduced its first personal unsecured loan in the year 2013. This company was originated by AI Goldstein, John Sun, and Paul Zhang, and its headquarters is located in Chicago, Illinois, the United States of America it assists its services in the United States and the United Kingdom. This company is having more than 550 employees.

One of the most attractive features of the Avant Credit Card is that you can prequalify with a soft credit check to see what rates and fees you’ll succeed in before you submit your application. The Avant Credit Card also reports your payment behavior to all three main credit bureaus–a must for anyone trying to improve their credit standing. But these are among the bare minimums you must expect when you’re seeking a card to help take your credit score to the next level. Other cards propose these basics and more, like a lack of annual fees, and some, offer rewards and other money-saving extras, too.

Some features of MyAvantCard Mastercard at MyAvantCard.com:

Here we are going to share some of the top features of this card that you just need to know:

- This card will be supportive for people to build their credit scores.

- Also, you need to pay a yearly fee which is $0 to $59.

- Also, the credit limit of this card is around $300 to $1,000.

- Its adjustable APR is 24.99% to 29.99%.

- To use this card, you don’t have to pay any additional fee.

- This card includes zero fraud liability for unauthorized charges.

- You don’t need to credit any amount as well.

- For the late payment, you are mandatory to pay $39 extra.

- The process of application is very simple and fast.

- All the customers will be able to make the payment 24*7.

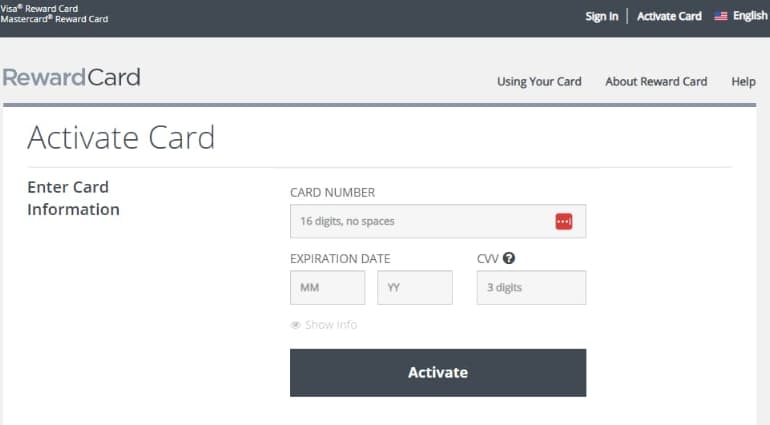

How can you start your application process for the MyAvantCard Personal Offer Code at MyAvantCard.com?

If you wish to start your application process then you have to read and follow all the steps which we are sharing in this section.

- First, you have to open your device which permits you to access the internet properly.

- Now, you have to make sure that you have a correctly working internet connection.

- Then, you have to open your default web browser and look for the Avant Card official website at www myavantcard com.

- After that, when the website gets open then you need to enter your offer code.

- Now, you need to enter the last 4 digits of your social security number and after entering all the details, you have to make click on the start application option which is available after the SSN section.

When you click on the start button then you don’t need a credit check but it will inevitably check out whether you are fit for this card or not. Similarly, if you are one of the fit people for this card then you have to complete the rest of the process where you need to enter some of the personal details in the application form.

- You need to enter your first and last name.

- After this, you need to enter your date of birth.

- you also need to enter your social security number.

- After that, you have to enter your phone number.

- Then, you have to enter your salary and the name of your employer.

- Finally, select the rent payment as per your demand.

When you complete the myavantcard.com application then click on the submit button and if they accept your application then you will get an instant notification about your credit limit also you will get the appropriate mail about your myavantcard.

FAQs (Frequently Asked Questions) on MyAvantCard.com:

-

Is Avant a Legit Company?

Yes, Avant is one of the legit online lenders as Avant is listed to do the business in the states its facilities which is one of the legal requirements to become a legitimate lender. Avant is in the business since the year 2012 and also having a safe website or your data will stay safe.

-

What Credit Score Do You Need for an Avant Credit Card?

The Avant credit card is mostly for people who are having a fair credit score and looking to repair or build credit. Essentially, you will get the best chance of passing with a credit score of at least 580.

-

Does Avant Verify Income?

All loan applications are compulsory to provide information related to their income source. As well, if you are employed by traditional means or getting benefits then the fastest method for us to validate your income and employment is by the online verification tool.

More Guides:

- MySprint com MyOrder

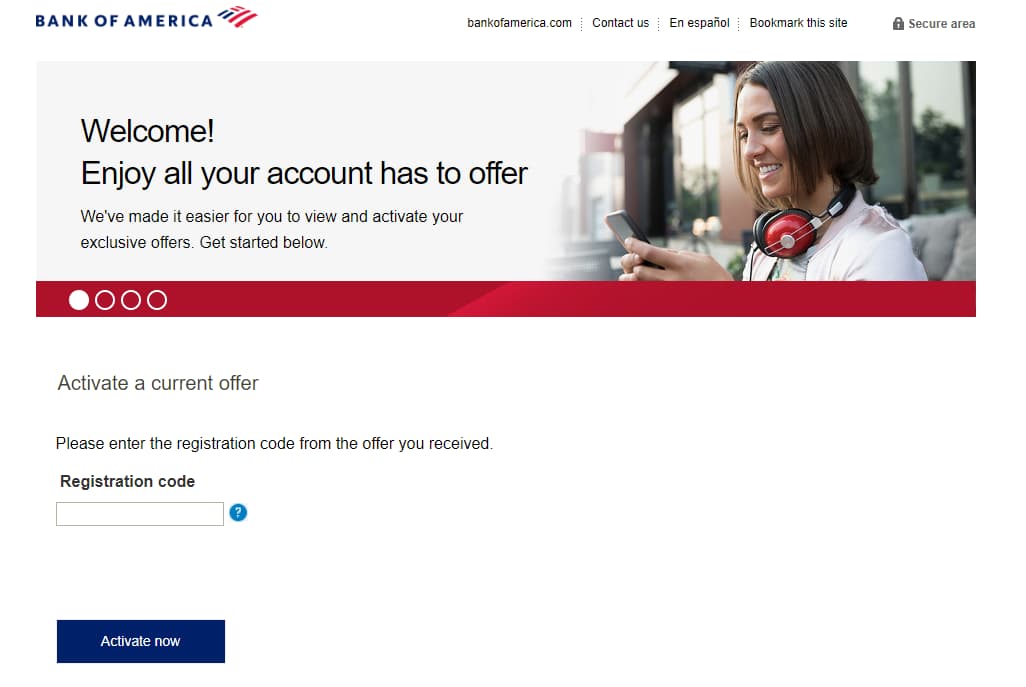

- AwardCardServices/Rewards

- MyMagicPhotos

- www Snapfish com Login

- TPAD2 Login

- www.Barclaysus.com/Activate

Conclusion:

We have shared everything MyAvantCard Mastercard in this article on “MyAvantCard.com” if the information that we shared helped you in any way then do share it with others so they can also profit from this article.